Atal Pension Yojana Calculator – APY Calculator

The Atal Pension Yojana Calculator is an online tool that helps to calculate the monthly, quarterly, or half-yearly contributions needed to achieve a desired pension amount after retirement (60 years). It also provides detailed information about the investment duration, ensuring individuals understand the total period they need to contribute based on their current age.

What is Atal Pension Yojana?

The Atal Pension Yojana (APY), introduced by the Government of India on June 1, 2015, is a pension scheme that provides universal social security for Indians, particularly targeting the underprivileged, poor, and workers in the unorganized sector. It is administered by the Pension Fund Regulatory and Development Authority (PFRDA) under the National Pension System (NPS) framework. Below is a detailed breakdown of its key features:

1. Background

- It was launched as part of the 2015-16 Budget initiative to create a universal social security system.

- It focuses on benefiting the poor, underprivileged, and those working in the unorganized sector.

2. Eligibility Criteria

- Open to all Indian citizens with a savings bank account.

- Minimum age: 18 years.

- Maximum age: 40 years.

3. Key Features

- Guaranteed Pension:

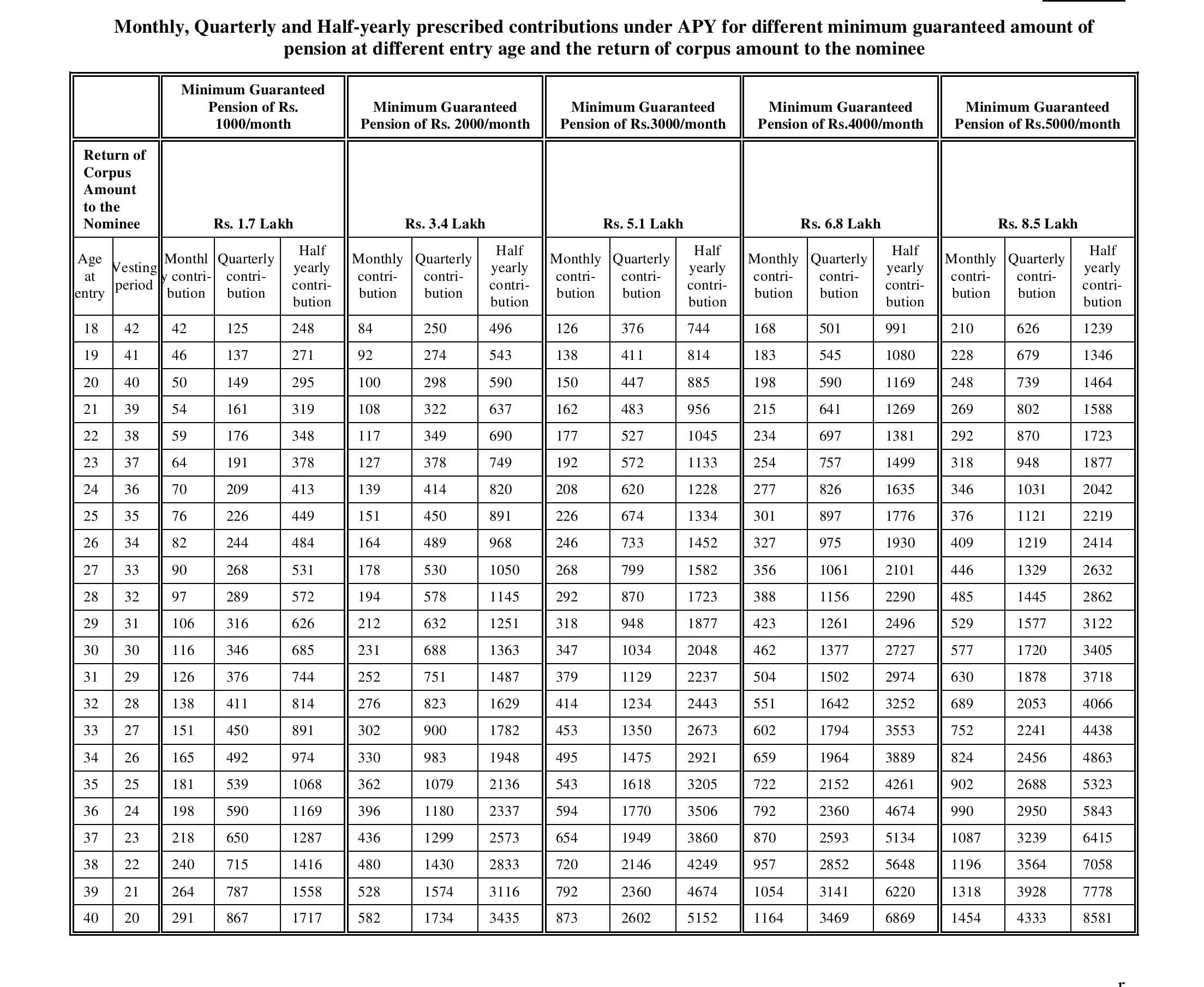

- Subscribers receive a guaranteed minimum monthly pension of ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000 after the age of 60.

- Pension for Spouse:

- Upon the subscriber’s demise, the spouse will continue to receive the same pension amount until their death.

- Pension Wealth to Nominee:

- After the death of both the subscriber and spouse, the accumulated pension wealth is paid to the nominee.

4. Contribution Requirements

- Contributions are auto debited from the subscriber’s savings bank account at the chosen frequency:

- Monthly

- Quarterly

- Half-yearly

- Contributions are required until the age of 60.

5. Central Government Co-Contribution

- Eligible subscribers who joined APY before December 31, 2015, and were not income taxpayers or covered under any statutory social security scheme received:

- 50% of the total contribution, up to ₹1,000 per annum, for 5 years (2015-16 to 2019-20).

6. State Government Contributions

- State governments may provide additional voluntary contributions to their residents subscribing to APY.

7. Enrollment Process

Enrollment is available through:

- All banks: Nationalized, private, rural, cooperative banks.

- Points of Presence (Service Providers) and Aggregators under NPS.

- Business Correspondents (BCs) and Microfinance Institutions (MFIs).

- Department of Posts (CBS platform).

8. Charges and Penalties

- Charges for delayed or non-payment of contributions will be levied as per PFRDA’s prescribed rules, in consultation with the Central Government.

9. Exit and Withdrawal

After 60 years:

- Guaranteed or higher pension, depending on investment returns.

Before 60 years (in exceptional cases):

- For death or specified illnesses, the accumulated pension wealth is given to the nominee or subscriber.

- Voluntary exits allow only the subscriber’s contributions and interest earned to be refunded.

- Government co-contributions and their interest will not be refunded.

10. Existing Subscribers of Swavalamban Scheme

- Migrated to APY if aged 18-40 years, unless opted out.

- Others will follow NPS regulations.

Atal Pension Yojana Contribution Chart

To download the PDF file in better quality, kindly join our Telegram group Join Telegram Group for PDF

What is the Atal Pension Yojana Calculator?

Atal Pension Yojana calculator helps to determine how much you need to contribute monthly, quarterly, or half-yearly to reach your desired pension amount. The required contribution depends on your age, the contribution type, and the pension amount you wish to receive after retirement. Our calculator will show you the investment duration in years, and the total amount you’ll invest, and provide a graph comparing monthly, quarterly, and half-yearly contributions.

Your contribution amount depends on three points:

1. Age- your age plays a crucial role. To be eligible for the scheme, you must be between 18 to 40 years old, and you must contribute until the age of 60 to start receiving the pension.

2. Contribution Type- You can choose to make your contributions on a monthly, quarterly, or half-yearly basis, with the amount automatically debited from your savings account based on your selected frequency.

3. Desired Monthly Pension– The desired monthly pension after retirement, which will begin at the age of 60, also influences the contribution amount. You can choose from five pension options: ₹1,000, ₹2,000, ₹3,000, ₹4,000, or ₹5,000, depending on your retirement goals.

The calculator will then determine the required contribution amount based on these three factors.

How to Use Atal Pension Yojana Calculator

To use the Atal Pension Yojana calculator, follow these steps:

Step 1: Select your age.

Step 2: Select your desired monthly pension (₹).

Step 3: Choose your contribution type (monthly, quarterly, or half-yearly).

Based on your input, the APY calculator will tell you:

- The monthly, quarterly, or half-yearly contribution amount you need to make to achieve your desired pension.

- The total investment duration in years, indicates how long you need to invest to reach your target pension.

- The total amount you will invest over the years, considering your selected contribution type and age.

- A graph to compare the different contribution types (monthly, quarterly, and half-yearly), helping you visualize which option suits your financial planning best.

Conclusion: Atal Pension Yojana Calculator estimates the monthly, quarterly, or half-yearly contributions needed to achieve your desired pension amount.

My Request to All: If you enjoy using my APY Calculator and website, please consider sharing the link of this page or the website with your friends. Additionally, if you have any requests, complaints, suggestions, or feedback, feel free to reach out via our WhatsApp channel or Telegram group.

Telegram Link – Join Our Telegram Channel

YouTube Link – Subscribe to Our YouTube Channel

For more tools, please visit our homepage at CalculationClub – Free Online Calculators

For additional tools in Hindi, you can visit MeterToFeet

Thank you for your support!