Lumpsum Calculator

Investing is one of the most effective ways to secure your financial future. While Systematic Investment Plans (SIPs) allow for gradual, periodic contributions, a Lumpsum Investment involves a one-time investment that can grow significantly over time. But how do you calculate the future value of a lump sum?

That’s where the Lumpsum Calculator comes in — a simple, user-friendly online tool that helps investors accurately estimate the potential returns on one-time mutual fund investments. One of its standout features is the interactive growth chart, which visually breaks down your investment into three key components: Invested Amount, Interest Earned, and Total Value. This clear graphical representation provides an insightful overview of how your wealth compounds over time.

With our Lumpsum Calculator, you can simplify your planning, make informed decisions, and invest with confidence.

What is a Lumpsum?

Lumpsum is a method of investing a large amount of money in one go, rather than through smaller, periodic contributions. It is commonly used in mutual funds and other investments. This approach is ideal for investors who have a significant amount of money available upfront and are looking to benefit from long-term growth.Differences between SIP (Systematic Investment Plan) and Lumpsum Investment:| Feature | SIP (Systematic Investment Plan) | Lumpsum Investment |

| Investment Type | Periodic investments at regular intervals (e.g., monthly) | One-time, upfront investment |

| Suitability | Suitable for those with a steady income or limited funds | Suitable for those with a large amount of money upfront |

| Risk Exposure | Low, as investments are spread over time, reducing market risk | Higher risk, as the entire amount is invested at once |

| Benefit of Compounding | Compounding over multiple smaller investments | Immediate compounding on the full amount |

| Flexibility | Flexible, can start/stop at any time or adjust investment amounts | Less flexible, as the investment is made in one go |

Why Use a Lumpsum Calculator?

A Lumpsum Calculator helps you estimate the potential growth of a one-time investment over a specified period. It takes into account the investment amount, expected rate of return, and the investment duration to provide an estimate of the total future value.Key benefits of using a Lumpsum Calculator include:- Accurate Projections: It gives you a clear idea of how much your one-time investment could grow over time.

- Time-Saving: Offers quick, error-free calculations that are challenging to perform manually.

- Financial Goal Setting: Helps you assess whether a one-time investment will help you achieve your long-term financial goals.

How Does a Lumpsum Calculator Work?

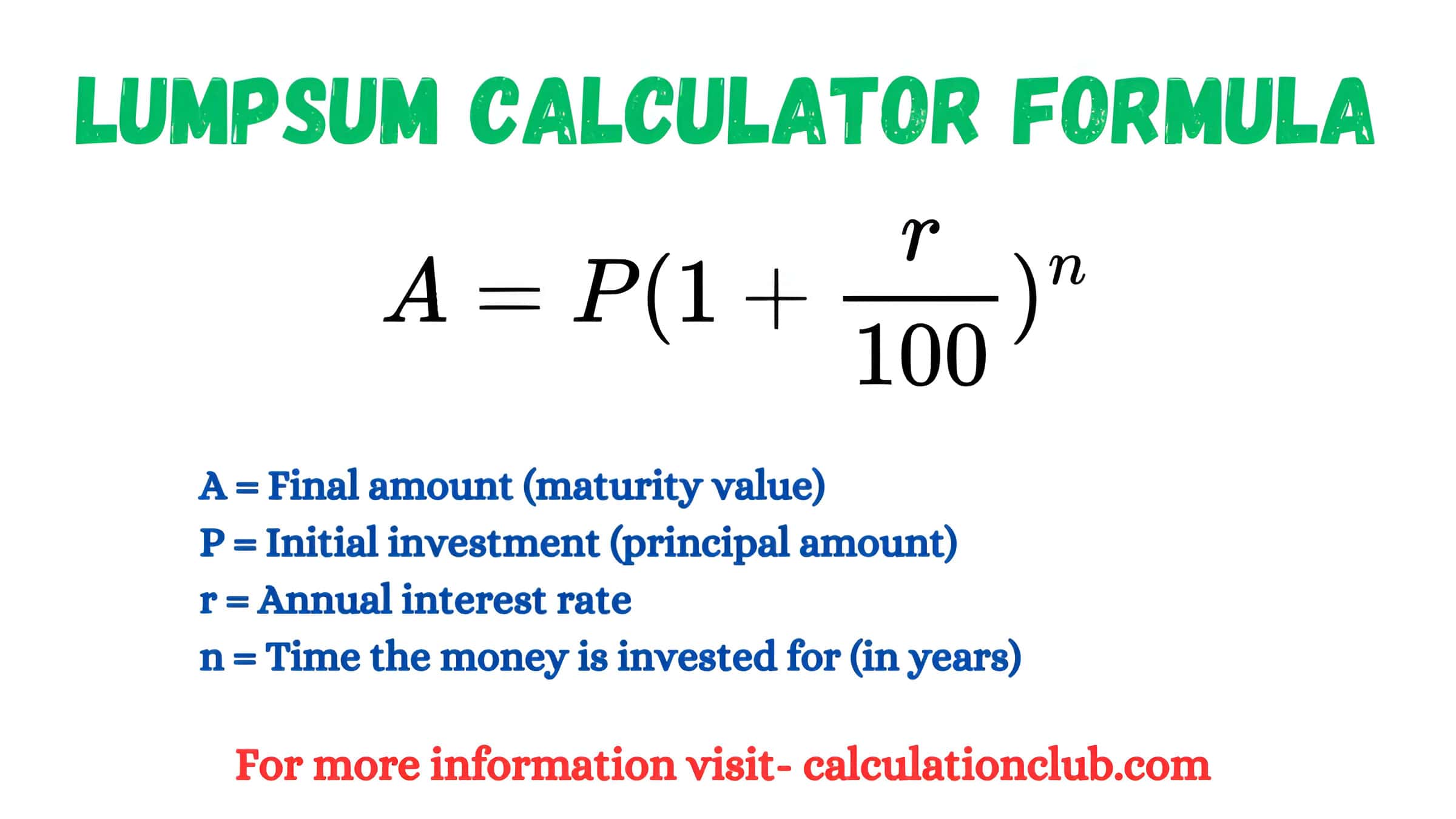

A Lumpsum Calculator works by applying the compound interest formula to your one-time investment. The compound interest ensures that the interest earned on your investment is reinvested, leading to exponential growth over time.Lumpsum Calculator Formula

The formula used by Lumpsum calculator is:A = P × (1 + r/100)nWhere:- A = Final amount (maturity value)

- P = Initial investment (principal amount)

- r = Annual interest rate

- n = Time the money is invested for (in years)

Example Calculation

Let’s say you invest Rs. 1,00,000 as a lumpsum amount for 10 years at an annual interest rate of 15%.- Initial investment (P): Rs. 1,00,000

- Annual interest rate (r): 15%

- Time period (n): 10 years

Step-by-Step Guide to Using a Lumpsum Calculator

To make the best use of a Lumpsum Calculator, follow these simple steps:Investment Amount (₹): Input the one-time investment amount. For example, if you want to invest ₹1,00,000, enter that value.Enter Expected Return Rate (p.a. %): Input the interest rate (expected returns) that you anticipate from your investment. For instance, if you expect a 15% annual return, enter “15%.”Choose Time Period (Years): Set the time frame for your investment. If you are planning to invest for 10 years, enter “10 years” into the calculator.View Results: The Lumpsum Calculator will automatically calculate and display the following:- Invested Amount: The initial amount you invested.

- Estimated Returns: The approximate returns you can expect based on the inputted interest rate.

- Total Value: The total value of your investment after the specified period, including both the invested amount and the returns.

- Using the keyboard: Manually input the value into the text box.

- Using the scroll bar: Adjust the value by dragging the scroll bar located below the input box.

- Up/Down Buttons: Located in the right corner of the input box, you can click the up button to increase the value or the down button to decrease it.

Key Features of a Lumpsum Calculator

1. Customization Options: Allows you to enter and adjust details like the investment amount, interest rate, and duration, making it easy to explore different scenarios.2. Multiple Input Methods: Users can enter values in three ways:- Using the keyboard to manually input values.

- Using the scroll bar to adjust values easily.

- Use the Up/Down buttons to increase or decrease values by clicking.

“120 thousand” in the international format. “1 lakh 20 thousand” in the Indian format.

These words appear when you hover your mouse over the numbers.5. Advanced Chart: This Lumpsum calculator features an advanced chart that displays the growth of your investment over time. The chart presents three lines throughout the investment period, representing: Investment Amount, Estimated Returns, and Total Value. This visual representation helps users easily track how their investments and returns grow over the years.6. Returns in Percentage: The calculator also shows the percentage of returns in the “Estimated Returns” section, giving users a clear idea of the growth rate of their investment in percentage terms.Note: To enable features like number format, advanced chart, and returns in percentage (show % return), click the ‘⛔‘ symbol on the right side of the section. When clicked, three checkboxes will appear, each corresponding to these features. Select the checkbox to activate the desired feature.

Advantages of Lumpsum Calculator

- Error-Free Calculations: Reduces the chances of errors that might occur when calculating manually.

- Quick and Easy Results: Saves time by providing instant results without needing to work through complex formulas.

- User-Friendly Interface: The calculator is accessible to everyone, regardless of financial knowledge.

FAQs on Lumpsum Calculator

1. What is the purpose of a Lumpsum Calculator? A Lumpsum Calculator helps investors estimate the future value of their one-time investments based on the initial amount, expected return rate, and investment duration.2. Can I adjust the investment amount or duration? Yes, you can adjust the investment amount, interest rate, and time period to explore different investment scenarios.3. Do Lumpsum calculator consider market risks? No, Lumpsum calculator do not account for market fluctuations; they provide projections based on a fixed rate of return.4. Are Lumpsum calculator free to use? Yes, this website offers a free Lumpsum Calculator for users to plan their investments.5. Can Lumpsum calculator be used for any type of investment? Lumpsum calculator are typically used for mutual funds, fixed deposits, and other one-time investment options.Conclusion: Calculate mutual fund returns from one-time investments with our Online Lumpsum Calculator. Clear results and investment growth chart included.My Request to All: If you enjoy using my Lumpsum Calculator and website, please consider sharing the link of this page or the website with your friends. Additionally, if you have any requests, complaints, suggestions, or feedback, feel free to reach out via our WhatsApp channel or Telegram group.

Telegram Link – Join Our Telegram Channel

YouTube Link – Subscribe to Our YouTube Channel

For more tools, please visit our homepage at CalculationClub – Free Online Calculators

For additional tools in Hindi, you can visit MeterToFeet

Thank you for your support!