SIP Calculator

Investing is one of the most effective ways to secure your financial future. A popular method for growing wealth over time is through Systematic Investment Plans (SIPs). But how can you determine the growth of your investments?

That’s where the SIP Calculator comes in — a user-friendly online tool that helps investors estimate the potential returns on their mutual fund investments made through SIPs. What sets this calculator apart is its advanced growth chart, which visually represents your investment journey. The chart displays three key lines: Investment Amount, Estimated Returns, and Total Value, allowing you to clearly track how your wealth accumulates over time.

In this article, we’ll explain what an SIP Calculator is, how it works, and why it’s an essential tool for smart financial planning.

What is an SIP?

SIP, or Systematic Investment Plan, is a method of investing in mutual funds where you invest a fixed amount of money at regular intervals (usually monthly). It encourages disciplined savings and helps investors benefit from the power of compounding. A SIP makes investing easy by spreading your investments over time, which can reduce the risk of market fluctuations.

Why Use an SIP Calculator?

The SIP Calculator is designed to help you estimate returns on your investment over a period of time. It simplifies financial planning by allowing you to input details like monthly investment, interest rate (expected return rate (p.a. %)), and investment duration, providing you with a projection of your future returns (Total Value).

Some key benefits of using an SIP Calculator include:

- Accurate Projections: It provides a close estimate of how much your investment could grow.

- Investment Comparison: It allows you to compare different investment plans or scenarios.

- Time-Saving: It offers quick, error-free calculations that are hard to achieve manually.

- Financial Goal Setting: Helps you determine how much you need to invest to achieve your goals.

How Does an SIP Calculator Work?

A SIP Calculator works by applying a mathematical formula that considers your monthly investment, the interest rate (expected return), and the investment duration. The calculator assumes compound interest, where your returns are reinvested, leading to exponential growth over time.

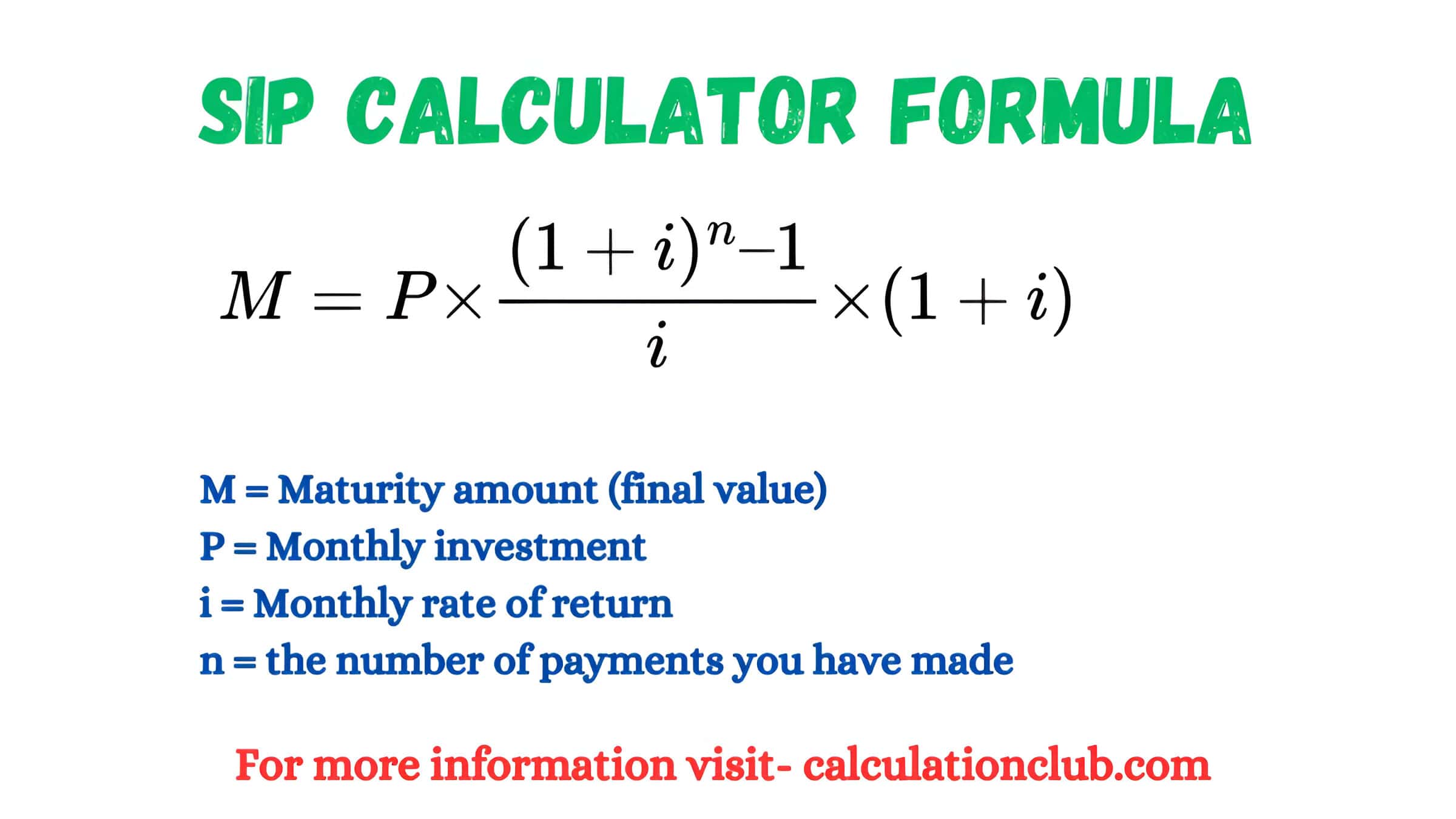

SIP Calculator Formula

The formula used by SIP calculator is:

M = P × [{(1 + i)^n – 1} / i] × (1 + i) or

M = P × [{(1 + i)n – 1} / i] × (1 + i)

Where:

- M = Maturity amount (final value)

- P = Monthly investment

- i = Monthly rate of return (as a decimal), Monthly rate of return = r%/12 = r/1200

- n = the number of payments you have made (10 years = 120)

Example Calculation

Let’s say you want to invest Rs. 5,000 per month for 10 years (or 120 months) at an annual interest rate (r) of 24%.

1. First, calculate the monthly rate of return:

Monthly rate of return i = 24% / 12 = 24/(100*12)=0.02

2. Now, plug the values into the formula:

- P = 5,000

- i = 0.02

- n = 120

3. Calculating: M = 5000 × [{(1 + 0.02)120 – 1} /0.02] × (1 +0.02)

M = 5000 × [{(1.02)120 – 1} /0.02] × (1.02)

For Complex Calculation use my “Free Online Calculator”

M = 2490116.573721452 ≈ 24,90,117

Step-by-Step Guide to Using an SIP Calculator

To make the best use of a SIP Calculator, follow these simple steps:

Enter Monthly Investment (₹):

Input the amount you plan to invest each month. For example, if you want to invest ₹5,000 per month, enter that value.

Enter Expected Return Rate (p.a. %):

Input the interest rate (expected returns) that you anticipate from your investment. For instance, if you expect a 12% annual return, enter “12%.”

Choose Time Period (Years):

Set the time frame for your investment. If you are planning to invest for 10 years, enter “10 years” into the calculator.

View Results:

The SIP Calculator will automatically calculate and display the following:

- Invested Amount: The total amount you will have invested over the chosen period.

- Estimated Returns: The approximate returns you can expect based on the inputted interest rate.

- Total Value: The final value of your investment at the end of the time period, which is the sum of your invested amount and the estimated returns.

Total Value = Invested Amount + Estimated Returns

Note: You can enter values in three ways:

- Using the keyboard: Manually input the value into the text box.

- Using the scroll bar: Adjust the value by dragging the scroll bar located below the input box.

- Up/Down Buttons: Located in the right corner of the input box, you can click the up button to increase the value or the down button to decrease it.

Key Features of an SIP Calculator

1. Customization Options: SIP calculator offer flexible customization, allowing users to input and adjust details such as the investment amount, interest rate, and duration. This enables investors to explore various investment scenarios and outcomes.

2. Multiple Input Methods: Users can enter values in three ways:

- Using the keyboard to manually input values.

- Using the scroll bar to adjust values easily.

- Use the Up/Down buttons to increase or decrease values by clicking.

3. Indian & International Number Formats: The calculator allows users to switch between Indian and international number formats. For example, a value like 2,656,686 (international) can be displayed as 26,56,686 (Indian format). This is useful for understanding figures in the format you are more comfortable with.

4. Value in Words: The calculator can display the monthly investment amount, estimated returns, and total value in words for better comprehension. For example, if you enter 1,20,000 in the monthly investment section, it will show:

“120 thousand” in the international format.

“1 lakh 20 thousand” in the Indian format.

These words appear when you hover your mouse over the numbers.

5. Advanced Chart: This SIP calculator features an advanced chart that displays the growth of your investment over time. The chart presents three lines throughout the investment period, representing: Investment Amount, Estimated Returns, and Total Value. This visual representation helps users easily track how their investments and returns grow over the years.

6. Returns in Percentage:

The calculator also shows the percentage of returns in the “Estimated Returns” section, giving users a clear idea of the growth rate of their investment in percentage terms.

Note: To enable features like number format, advanced chart, and returns in percentage (show % return), click the ‘⛔‘ symbol on the right side of the section. When clicked, three checkboxes will appear, each corresponding to these features. Select the checkbox to activate the desired feature.

Advantages of SIP Calculator over Manual Calculations

Calculating SIP returns manually can be a tedious and error-prone process. Here’s why an SIP Calculator is better:

Error-Free: SIP calculator eliminate the chances of mistakes that often occur with manual calculations.

Quick Results: Instead of spending time calculating complex formulas, you can get instant results with an SIP calculator.

User-Friendly: The simple interface of SIP calculator makes them accessible to everyone, regardless of their financial knowledge.

FAQs of SIP Calculator

1. What is the purpose of an SIP Calculator?

The SIP Calculator helps investors estimate the future value of their investments based on monthly contributions, expected returns, and the duration of investment.

2. Can I change the investment amount or duration in an SIP Calculator?

Yes, this SIP calculator allow customization, so you can adjust the investment amount, interest rate, and duration.

3. Do SIP calculator include market risks?

No, SIP calculator do not account for market risks or fluctuations. They provide projections based on a fixed rate of return.

4. Are SIP calculator free to use?

Yes, this websites offer free SIP calculator for users to plan their investments.

5. Can SIP calculator be used for all types of investments?

SIP calculator are primarily designed for mutual fund investments. However, they can be adapted to other types of regular investment plans.

Conclusion: Calculate SIP returns instantly with our online SIP Calculator. Visualize your investment growth with an interactive chart showing returns, value & more.

My Request to All: If you enjoy using my SIP Calculator and website, please consider sharing the link of this page or the website with your friends. Additionally, if you have any requests, complaints, suggestions, or feedback, feel free to reach out via our WhatsApp channel or Telegram group.

Telegram Link – Join Our Telegram Channel

YouTube Link – Subscribe to Our YouTube Channel

For more tools, please visit our homepage at CalculationClub – Free Online Calculators

For additional tools in Hindi, you can visit MeterToFeet

Thank you for your support!